Deal or No Deal: Valuing An 18 Unit Multi-Family

Deal or No Deal: An ongoing series where I value a specific property. This property is an 18 unit apartment building in Pontiac, MI listed for $1,450,000.

A regular feature I do is called “Deal or No Deal”, where I find a random property on the internet (oh, excuse me, web 3.0) and go through my proprietary (lol) underwriting process to determine if it is worth buying.

In previous articles here and here, I outlined my 3 step process for evaluating a property:

Does this generally meet my screening criteria? Yes, go to 2.

Does this pass the sniff test a.k.a. back of the napkin math? Yes, go to 3.

Perform underwriting.

The properties I evaluate in these articles are listed online using publicly posted information that you can access yourself.

Spoiler alert for today’s property: At first I was like ☺, then I was like ☹.

Property: 18 Unit Multi-Family Building

Source: LoopNet

Address: 51 Spokane Dr, Pontiac, MI

Units: 18

Asking Price: $1,450,000

Step 1: Does this generally meet my screening criteria?

Yes, so I will go to step 2. (Typically the properties I will evaluate for these articles don’t meet my personal criteria that I listed in this article, but maybe they will meet yours.)

Step 2: What is the back of the napkin math?

Information I need:

Unit breakdown

• 2 bedroom = 18

Market rents (Normally I already know market rents for an area I’m buying in, but for these random properties I am evaluating in areas I may not be familiar with, I will be using the fair market rents published by HUD, which are generally pretty accurate for middle of the road type properties.)

• 2 bedroom = $1,084/month

Market cap rate (Normally I already know the general market cap for an area I’m buying in, but for these random properties I am evaluating in areas I may not be familiar with, I make a general guess at a cap rate based on experience and then do a sanity check with online sources.)

• 7.0%

Napkin math:

Gross potential rent (GPR): $1,084/month/unit x 18 units x 12 months = $234,144 annual GPR

Potential actual rent (6% vacancy/credit loss assumption): $234,144 x 94% = $220,095

Potential NOI:

• 30% expense ratio: $220,095 x 70% = $154,067

• 40% expense ratio: $220,095 x 60% = $132,057

Estimated value range

• High: $154,067 NOI / 7.0% market cap rate = $2,200,954

• Low: $132,057 NOI / 7.0% market cap rate = $1,886,532

Selling list price: $1,450,000

• The list price is well below the low end of my value estimate range, so this is a potential good/great deal.

Since this property passes the napkin math test, I will proceed to full underwriting.

Step 3: Determine offer price based on full underwriting

If this was a deal I was actually pursuing, I would call the listing broker and possibly set up a property visit to assess the general condition. For the purposes of this article, I will use the online images and general assumptions of condition based on the age and property class.

The underwriting model I use is the Apartment Acquisition Model with Monte Carlo Simulation from A.CRE. I will estimate property value using two scenarios:

Property value with in-place financials

Property value with year 2 or so financials I believe are realistic

Scenario 1: Value with in-place financials

1. Determine adjusted NOI from in-place financials

From the listing, the following are the broker provided expenses:

Marketing: $900

Administrative: $900

Utilities: $8,100

Payroll: $8,100

Repairs & Maintenance: $10,800

Contracted Services: $3,600

Management Fee: $8,222

Insurance: $4,050

Property Tax: $15,222

Replacement Reserve: $1,800

Income: I will leave the in-place income of $164,445 as-is for scenario 1.

Marketing: There are many free advertising options that work just fine, but I will keep the in-place amount of $900 as this is in a metro area and finding better tenants might be a better choice through paid advertising.

Administration: These are things like tax returns, your asset management time, etc. $900 feels a bit light for this. I would assume $2,000 for this expense.

Utilities: I will use actual per the listing of $8,100 as the property is 100% occupied.

Payroll: A small property like this requires no payroll. The $8,100 being paid by the current owner is probably paying themselves for walking around and picking up some trash every week or two. I will assume $0.

Repairs & Maintenance: The stated R&M is about 6% of gross rents plus there is a $3,600 contracted services expense that I will roll into R&M. The 6% seems quite low for a 1940 built building, although 15 of the 18 units heave been renovated in the last 2 years, so that should keep R&M down for awhile. I will assume about 8% of gross rents for $14,000 plus the $3,600 contracted service. I don’t know what the contracted service is, perhaps pest control and/or grounds maintenance.

Management Fee: The seller shows 5%, but this seems low for such a small property. I would normally expect a 3rd party management fee to be 6-8% of collected rent for a property like this. I’ll split the different and assume 7%.

Property Insurance: Current property insurance is $225/unit. Based on my experience, this is crazy low, especially for an older building. I will use $500/unit, so I will assume $9,000 for insurance. Normally you would want to receive a quote from an insurance agent at this stage.

Property Tax: Per the assessor’s office, the current assessment is $267,890. If we were to buy at about $1,450,000, we can expect our tax to be eventually be about 5.4x the current. That is obviously an insane tax increase. I did some digging online to try to understand the local property assessment method, but couldn’t find anything specific, so I called the assessor’s office to understand how they assess

Long story short, Michigan does not allow municipalities to “chase sales” for property tax increases. Neighborhoods are assessed broadly and a multiplier is applied to the current assessment to determine the new assessment. With this in mind, we can assume our tax assessment will never get to 5.4x current during our 10 year hold period, but it will certainly go up significantly at some point. The question is - when?

For the purposes of this analysis, I will assume the year 1 tax increase will not be too crazy based on my conversation with the assessor. To be conservative, I will add 20% to the current assessment and assume $18,000 in property tax.

Property tax increases can be a huge trap for a new buyer. Do your homework on what your assessed value will be in the future.

This is what my year 1 operating expenses look like after making these adjustments:

Looking at my total expenses, my estimated OpEx ratio is 36%. This is pretty good as typical is 30-40%.

Adjusted NOI = $162,635 revenue less vacancy - $56,484 adjusted expenses = $106,151

Estimated value = $106,151 NOI / 7.0% market cap rate = $1,516,437

Since my estimated value is higher than the $1,450,000 asking price, I will use the lower asking price for the remainder of my scenario 1 analysis as the potential purchase price.

2. Determine Annual Debt Service

This property is a prime candidate for agency debt from either Fannie Mae or Freddie Mac Small Balance Loan programs. If you are an inexperienced buyer, you likely won’t qualify for agency debt without finding an experience partner.

Using the below loan assumptions for lending, my annual debt service will be $47,768.

3. Determine Day 1 CapEx & Annual CapEx Spend

Day 1 CapEx

Reviewing the images in the listing, the property looks to be well maintained. Google streetview images don’t seem to be reliable. The current owners purchased in 2019 and appear to have done some improvements and Google streetview images of the property look OK, but a bit tired, so I’m assuming streetview is prior to 2019.

Google satellite did not give enough resolution to the see roof condition. The listing states that 2 of the units have new roofs. I will assume 25% life for the remaining 16 units since they have recently replaced some of the roofs.

One driveway looks to be in average condition with the other side being repaved recently. I will assume 25% life remaining on the old pavement.

The interiors of 15/18 units have been rehabbed recently. I will assume the remaining 3 will need rehab at the next tenant move out and will bake this into day 1 capex of $20,000. Based on the listing photos of the rehabbed units, I will assume that all rehabbed units are still in good condition and have 90% life left for all interior capex items.

The listing stated new heating systems installed 5 years ago, so that should last for our 10 year hold period with regular maintenance.

The listing stated all hot water tanks are 5 years old, so I will assume 50% life for those.

Estimated Annual CapEx

I estimate annual capex spend with a spreadsheet that captures my entire holding period (10 years) and inflation estimate. If the remaining life of a capex item is longer than my hold period, I do not need to account for this item in my annual capex spend estimate - my spreadsheet will automatically put these as $0.

Pro Tip: Figure out what you need to put into capex reserves on a monthly basis to cover future capex expenses and have the discipline to deposit in a reserve account on a monthly basis. Do not convince yourself that you won’t need to replace the 18 year old furnace in order to use that “extra” money to buy a boat. Go find a friend that has a boat instead.

After filling in all the capex items based on my estimate of life remaining, it looks like this:

Because estimating capex is not a perfect science, I will take the average capex based on my hold period. For this property it is $100/month/unit, which is the unit of measure my model requires as an input.

This equates to $1,200/unit/year. The normal “rule of thumb” is to assume $250/unit/year for capex. You can see how off this assumption can be when you consider all possible capex over your hold period.

Pro Tip: One of the reasons some deal sponsors have short hold periods of 3-5 years is because of capex. The longer you hold, the more capex you will incur. The name of the game for some is to try to dump deferred maintenance onto the next guy.

4. Determine total acquisition cost

My estimate for total acquisition cost is $465,604.

5. Determine year 1 cash-on cash return

Annual cash flow = Adjusted NOI - Annual Debt Service - Annual CapEx = $106,151 - $47,768 - $21,600 = $36,783

Total acquisition cost = $465,604

Year 1 Cash-on-cash return = $36,783 / $465,604 = 7.9%

My normal minimum threshold for year 1 cash-on-cash is 8% for a property like this and I’m at that, so all good, right?

Wrong. Remember from the debt service section that we are assuming 2 years of interest only (I/O) payments, so that is inflating our year 1 cash flow significantly.

Re-running the analysis with no interest only period, the year 1 cash on cash drops to a pathetic 3.8%. That means that my year 3 cash flow when I include the 2 years of interest only payments will likely be terrible and my 10 year average is probably not great, Bob.

To meet my 8% minimum cash-on-cash threshold for year 1, the maximum offer I can make is $1,200,000. I do this by using the “goal seek” function in Excel to fix my desired return at 8% and let Excel find the purchase to give that result. Now on to scenario 2.

Scenario 2: Estimating Value Add Potential

Scenario 2 is where we determine what, if any, value add opportunity there is for this property. As a reminder, value add is where you look to increase the NOI through rent increases and/or expense reductions. This results in increased cash flow and property value. I have adjusted the purchase price to be $1,200,000 for scenario 2.

Also, this scenario considers growth assumptions to determine a 10 year future projection. In general, I hate trying to predict the future. It’s a fool’s errand and you will never be right. I like Unlevered Yield On Cost that doesn’t require a crystal ball, which you can read about here, and you can read about why I think IRR is generally not useful here.

1. Revisit Scenario 1 Adjusted T-12 NOI

Rent Increase Value Add: Based on estimated market rents of about $1,084/month, it appears that the in-place average rent of $801 is quite low. If we are able to add $100/month to get to an average rent of $901/month, we can gain:

Rent Increase Cash Flow Add = ($901/unit/month - $801/unit/month) x 18 x 12 = $21,600 annual

Rent Increase Value Add = $21,600 / 7.0% cap rate = $308,571

Cost: 15/18 units are already fully rehabbed. We assumed $20,000 in scenario 1 to rehab the remaining units, but it appears these units may just be under market regardless of spending capex to improve. But why?

This is where you need to really dig into a market to understand the specifics of a property - there can be significant property value differences from street to street in the same area. Is this a war zone? Old nuclear waste dump? Incompetent operator? Who knows, but why the rents are so far below market would need to be figured out with certainty.

Year 1 ROI = $21,600 / $0 = infinity %

Expenses Value Add: We already adjusted most of the expenses in scenario 1, so there isn’t much to do here. Electric, gas and water are all paid by the tenant and the heating systems and water heaters are all about 5 years old, so no real value to be found here.

The landlord pays sewer and is based on a proportion of water usage, which I will assume is 80%. I will assume the units do not have water saving fixtures installed. If I can install water saving devices at a cost of $400/unit and can reduce total water usage by 20%, I can reduce sewer costs by 16%. Of the total $8,100 of utilities, which are comprised of sewer and trash, I will assume the sewer is $6,000.

Sewer Expense Reduction = $6,000 x 16% = $960 annual savings

Sewer Reduction Value Add = $960 / 7.0% cap rate = $13,714

Cost = $400/unit x 18 units = $7,200

Year 1 ROI = $960 / $7,200 = 13%

This isn’t a huge ROI, so is it worth doing? Probably not, but it depends on if this return is accretive to the property return without doing this.

Spoiler Alert: I jumped ahead and looked at the property level year 1 return without doing the sewer expense reduction and the property level return is higher than 13%. Given that, this would not be a value add project that would be worthwhile since it has a lower return than the property in its current condition.

In total, I believe there is about $21,000 incremental cash flow available (on top of in-place cash flow of $46,751 from scenario 1 purchase price of $1,200,000) with a non-recurring cost of $0. This will add about $300,000 in property value. I like it a lot.

2. Determine Growth Rates

The annual growth assumptions for the 10 year projection are:

Rent growth percentage: 3% for this metro market, which is a typical historic rent inflation amount.

Expense growth percentage: 4%. My rule of thumb is I always want to assume a slightly higher expense growth than rent growth for a stabilized year.

Additional income (laundry, storage, etc.) growth percentage: Property has no additional income.

Capital expense growth percentage: 4%. I usually have this equal to the expense growth.

Cap rate change percentage: (-)0.10% annually. I never assume a cap rate compression.

3. Review Returns

After editing my scenario 2 analysis for increasing the rent to $901/month average and freezing the purchase price at $1,200,000 (value from scenario 1), I will look at the primary metrics I care about with fixed assumptions for the various growth factors:

Year 1 Unlevered Yield On Cost (UYOC): 8.5% - great for a zero effort value add plan (See this article for an explainer on UYOC)

Year 1 Cash-On-Cash Return: 17.1% - prettay prettay good

Year 1 Breakeven Occupancy: 58% - exxxxxxcellente

10 Year Average Cash-on-Cash Return: 15% - very niiiiice

10 Year Levered Equity Multiple: 4.7x - yes, I believe I like this

10 Year Levered IRR: 22.5% - schwing!

4. Run Random Simulation

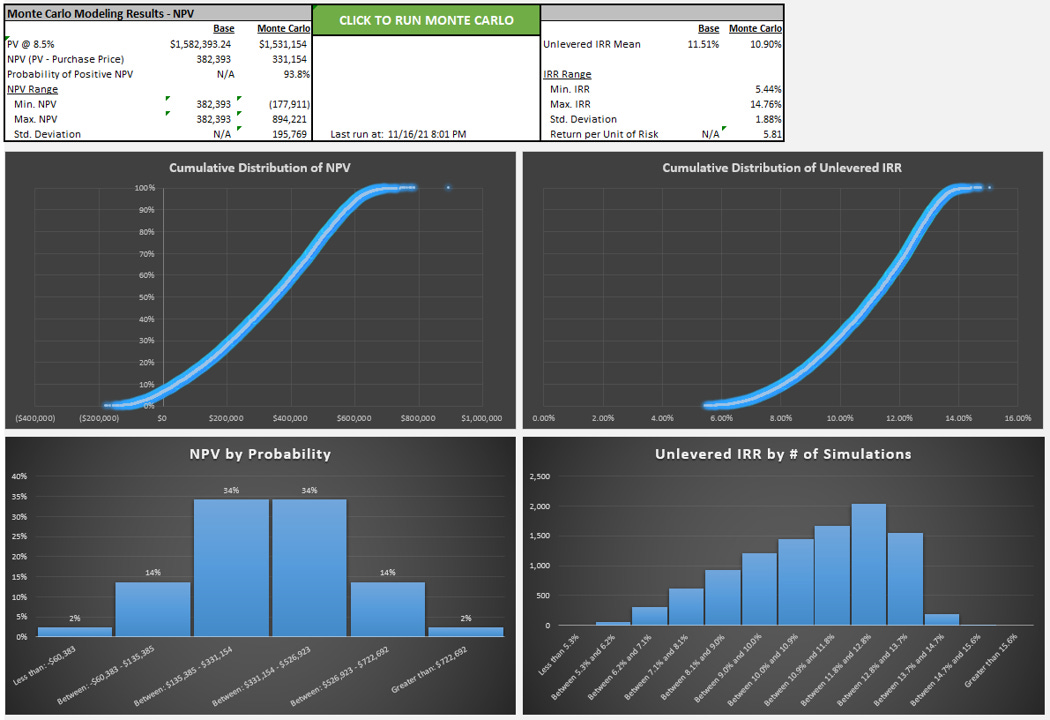

The final step I do is determine my inputs for the Monte Carlo simulation. This simulation allows for me to enter ranges for all my growth assumptions and then runs 10,000 random simulations. The output looks like the following:

What this output tells me is that I have a decent likelihood of having higher returns than I predicted when using fixed numbers for growth assumptions. This improves my confidence in buying this property.

As a note, you can see that the Monte Carlo gives outcomes that have a negative net present value (NPV). This doesn’t mean there were outcomes where I lost money, it just means there are outcomes where I potentially overpaid (lower return than I had desired).

Final Thoughts

At $1.2 million, I would definitely buy this property. Given that it is almost 20% lower than the list price, I would have no confidence that the seller would accept my offer, but I’d probably throw one out there anyway. It takes 10 minutes to write a letter of intent and who knows, maybe you’ll get lucky.

In the current market, you will probably look at 50-100 deals before you find one that sticks. It’s a numbers game. You just have to keep grinding to find the one that makes sense for you.

I spent about 45 minutes in total doing the full underwriting. As a newbie, there’s value in going through this process many times even if ends up being a waste of time. As you get more experience, it’s a cost of doing business so-to-speak, but make every effort to minimize going down a dead end road. In other words, don’t be me: