Internal Rate of Return (IRR): How Useful Is It?

IRR requires too many future assumptions to be a highly confident number and can be easily manipulated.

Tl:dr

IRR requires too many future assumptions to be a highly confident number

IRR is easily manipulated to give the results you want

IRR does not tell you how returns are allocated (i.e., risk)

Isn’t it amazing how every real estate deal a sponsor promotes somehow magically shows an IRR of about 15%? What a world we live in where every sponsor has the ability to predict such a beautiful return over a 5-10 year period. So how do these financial magicians do it?

What Is IRR?

IRR is the annual growth rate a property is expected to return.

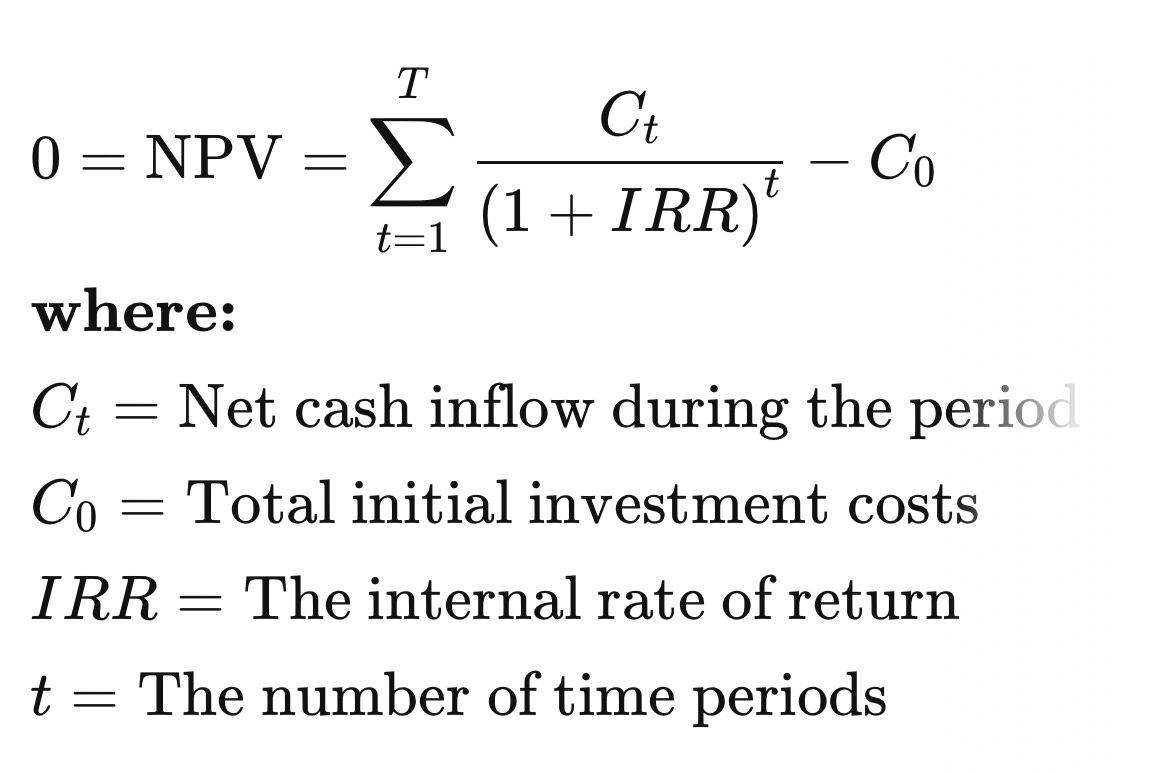

Internal rate of return (IRR) is a discount rate that makes the net present value of all cash flows equal to zero in a discounted cash flow analysis. That doesn’t sound like math I can do on a napkin.

In plain English, it is the annual growth rate a property is expected to return that considers the timing of when cash flows are received. Learn more about IRR here. Sounds like an awesome metric, so why does it kind of stink?

How To Calculate IRR

Don’t bother trying to do it by hand. Just use the IRR function in Excel. Here’s the hand calculation for you math lunatics:

Too Many Assumptions Needed

You have no ability to have high confidence in your output.

IRR requires a set time period in order to be calculated. Typically, in real estate deals, IRR will be given for 5 or 10 year period. The following are all the ongoing assumptions after year 1 that a real estate investor needs to make in order to calculate IRR:

Rent growth

Operating expense inflation

Vacancy/credit losses

Capital expense inflation

Market cap rate change

Re-leasing cost inflation

Every one of these assumptions has a margin of error. Add up all the margins, and yeah, you have no ability to have a high confidence in your output. If you think that you, as a simpleton real estate person, can predict the future, consider that the people who predict the future for a living (econ PhDs) probably have a worse track record than your degenerate sports gambler cousin. So, chew that over while you’re proudly promoting your 17% IRR can’t miss offering.

A risk mitigation to help understand the variations in IRR assumptions and how they impact returns is to run a Monte Carlo analysis, which allows for multiple values for your future assumptions. Check out my previous article on using Monte Carlo simulation for real estate.

IRR Can Be Easily Manipulated

Assumptions can be juiced to get to whatever nice looking number you need.

Given all the assumptions that are needed to calculate IRR, it is fairly easy to manipulate these assumptions to juice returns without making significant changes.

As an example, I recently underwrote a $7 million property using a 2.5% annual rent growth assumption that gave a limited partner IRR of 12%. Decent return, but nothing outstanding and probably wouldn’t get much love from an investor that has been seeing 15% IRRs on every other pitch deck.

I bumped the annual rent growth up 0.5% to 3% and IRR increased by 2% to 14%. A 3.5% rent growth bumped IRR to almost 16%.

I have no confidence in what the future rent growth rate will be, except that it is probably greater than 0% over a 5-10 year period based on history. So, why wouldn’t I just plug in 3.5%? Or even 4% if I’m feeling lucky that particular day? Questions for Plato.

For the typical limited partner, would they question a 2.5% annual rent growth assumption vs a 3.5%? 99% probably won’t even calculate what you are using for a rent growth assumption. This manipulation can be done with every assumption to juice the IRR a bit to get it to whatever nice looking number you want. Voila, you just learned how the magicians all do it.

Oh, and guess what? A typical GP will never go back and report on actual performance vs pro forma investor pitch deck fairy tale numbers. There’s no downside for a deal sponsor to just juice those assumptions a bit.

And it all doesn’t matter anyway. Everything goes up and up and up in the current market, so nobody will ever bother to check on your predictions. Everyone is a genius in real estate these days.

IRR Tells You Nothing About Risk

A higher IRR may not be the best choice between two properties

Consider two different real estate deals:

Deal 1 is in a solid tertiary market with historically minimal cap rate changes, but has great cash flow that gives an IRR of 15%.

Deal 2 is in a hot primary market that has seen significant cap rate compression the last few years, but has very low cash flow that gives an IRR of 18%.

The second seems like the no brainer to choose at the higher 18%, yes? Maybe not. Let's look at how the return is allocated at a rough level:

Deal 1

Almost all the IRR is based on cash flow, which (to a certain degree) is within a real estate investor's control.

You receive a return (cash) on a regular basis.

The IRR has a relatively low risk of being impacted by market events out of your control (but not always - hello COVID).

Deal 2

All of the return is based on speculation (i.e. gambling) that cap rates will continue to compress, which is not within your control.

From a risk standpoint, I would have a much higher confidence level in predicting the IRR for Deal 1 given my higher relative confidence in predicting cash flow than predicting market cap rate changes. Deal 1 would generally be the better choice for a more risk averse investor and probably a better choice for a deal sponsor that is in the early stages of growing their business.

Pro Tip: If you ever see a real estate offering that is predicting cap rate compression as part of the future value prediction, run for the hills. No credible GP will ever predict cap rate compression in their analysis.

So Why Bother With IRR Then?

From an underwriting perspective, it can be used to make sure you are in the ballpark of a good investment - if you use conservative growth assumptions. Just be aware it's easy to fall into the trap of twisting yourself in knots over, "But the IRR on this deal is only 14.57826% and I need at least 15.0%!!!" Who cares. You’re not that good at predicting the future to have any confidence in tenths of a percent change. No one is.

Also, consider using a range of IRR. If I’m going to present IRR to investors, my two cent opinion is this is a more honest approach as it shows a more realistic possible outcome and you implicitly communicate there is margin for error in your analysis. I forget, have I told you about why I like Monte Carlo simulations? It does exactly this.

Reality

The reality is IRR is an expected number for a potential investor to see, so even after bashing the usefulness, I still present it to investors. Using conservative growth assumptions will let you sleep at night knowing you will hopefully outperform investor expectations.